Dynamic risk scoring

Make informed decisions based on multiple factors and their weight.

Dynamic risk scoring assesses applicants and their activity in real-time based on the applicant events (transactions, sign-up, login, and so on) received via the API. Each event is screened through multiple factors, each weighted differently depending on its importance to a specific company.

Such a flexible approach allows for the creation of customizable risk profiles, adapting dynamically to user-specific criteria and guaranteeing accurate and timely risk assessment.

The multi-factor risk score shows how likely a user is to engage in suspicious or fraudulent behavior. It might be calculated based on multiple factors, such as:

- Onboarding score

- Applicant location

- Payment method check results

- Number of payment accounts used

- Usage of untrusted and risky devices

- Source of Income based on questionnaire (SoI)

- Transaction risk score

- and more

The score helps companies decide whether to investigate their users further, apply additional checks, or reject them.

You can use the risk factors to create a custom risk matrix and categorize the detected risks as low, medium, or high to help companies prioritize them.

How dynamic risk scoring works

Ongoing risk assessment utilizes risk factors represented by scoring transaction tags. You can create a tag for any risk factor related to your applicants and specify the weight for it.

NoteThe transaction tags differ from the applicant tags as they are associated particularly with transactions versus that of applicant tags, which are always associated with your applicants. The applicant tags can be set up on the Tags page in the Dashboard.

Scoring transaction tags will be added to the rules, allowing Sumsub to summarize their weights and produce the final risk score associated with an applicant as a separate output tag.

Here are some tag examples that you can use to express risk factors:

| Sample factor | Description |

|---|---|

| Onboarding score | Onboarding behavior signals. |

| GEO | IP-based applicant residence detection results. |

| Risky payment method | Payment method check results. |

| Payment accounts | Number of payment accounts used by the applicant. |

| Device | Usage analysis of untrusted and risky devices. |

| SoI | Source of income analysis based on the questionnaire answers. |

| Txn risk | The financial transaction risk score based on the screening results. |

Set up dynamic risk scoring

To set up dynamic risk scoring:

- Enable dynamic risk scoring for the selected level.

- Create transaction monitoring tags representing risk factors that you need, like the ones described above, and the name of the tag, which will represent the total score, for example, Total Risk Score.

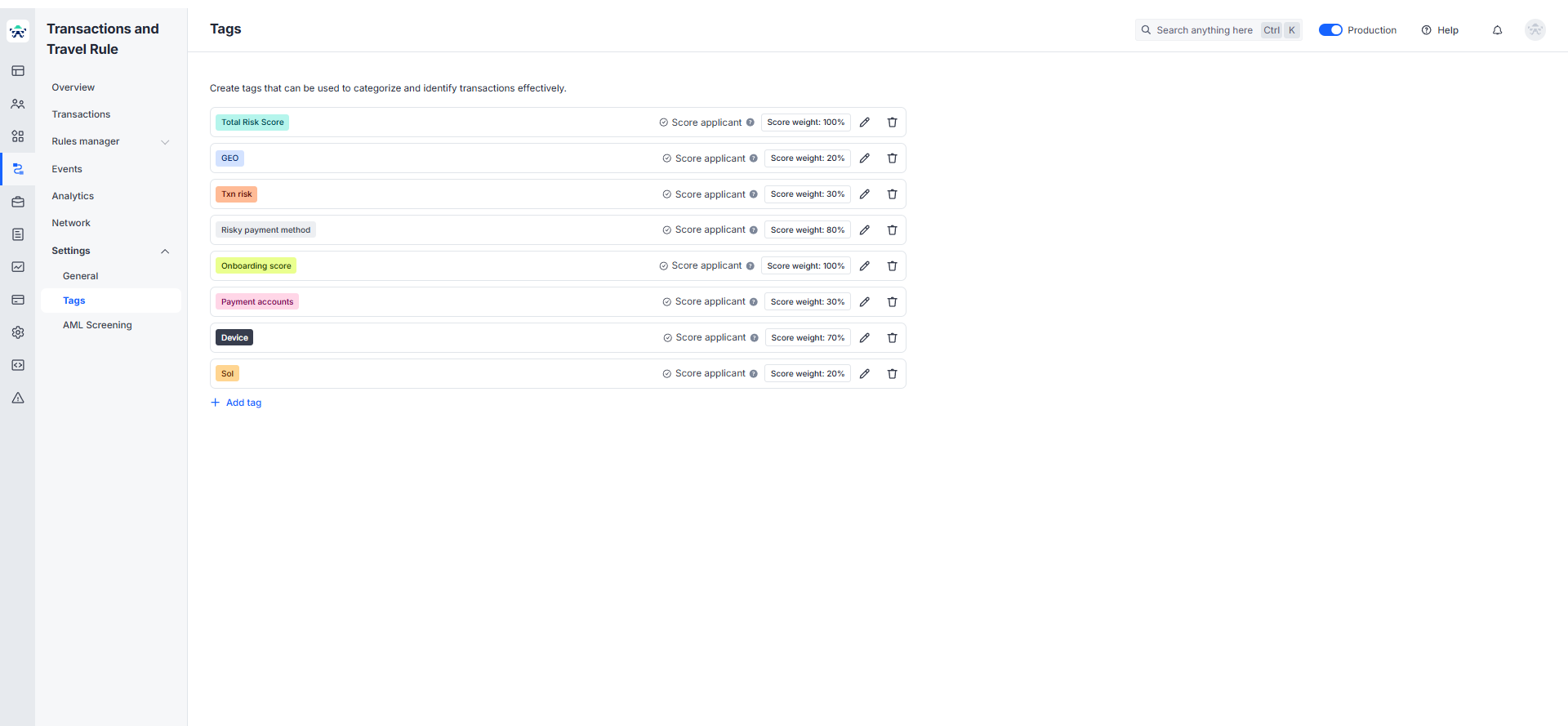

- Navigate to Transaction Monitoring settings, open Tags, and select the Score applicant checkbox near the tag.

- Add the tags you created above to your rules to start scoring transactions based on the transaction type.

- Create and install a post-scoring rule Calculates applicant assessment aggregates that will constantly summarize the scores from all the rules with the scoring tags and calculate the final score based on the tags' weights.

- Assign the output tag (Total Risk Score) to the post-scoring rule to display the total score.

Step 1: Enable dynamic risk scoring

To allow Sumsub to calculate the risk score, you need to enable it for a specific level.

- If you have never used dynamic risk scoring before, contact your dedicated Customer Success Manager at [email protected].

- If you already have dynamic risk scoring enabled, navigate to Integrations, pick the level to edit, and select the Calculate applicant score checkbox in the Applicant scoring section of the Configurations tab.

Now the applicant score will be automatically updated each time the level changes, based on your configured rules.

Step 2: Create tags

To create a tag:

- In the Dashboard, open the Tags page and click Add tag. The first tag should represent the total score of the dynamic risk assessment.

- Enter the tag name (Total Risk Score), choose the bar color, and select the Score applicant checkbox to use the tag for scoring applicants as part of ongoing risk assessment, and keep the weight to 100%.

- Save your changes.

ImportantTo use tags for ongoing risk assessment, make sure to select the Score applicant checkbox when creating the tag.

Step 3: Add tags to rules

To add a tag to a rule:

- Create a rule and set up its condition. Let’s imagine the following scenario: we need to track financial risk by alerting all transactions >€5k in the rolling 24h and checking if the applicant's residence country belongs to a high-risk countries list.

- Navigate to Add tags to the transaction and add the necessary scoring tag to the rule (GEO in our case for the first rule, and Txn risk for the second).

- Set up the score for each rule, which will be taken into the calculation of each risk factor.

Now let’s specify the logic of the Total Score calculation:

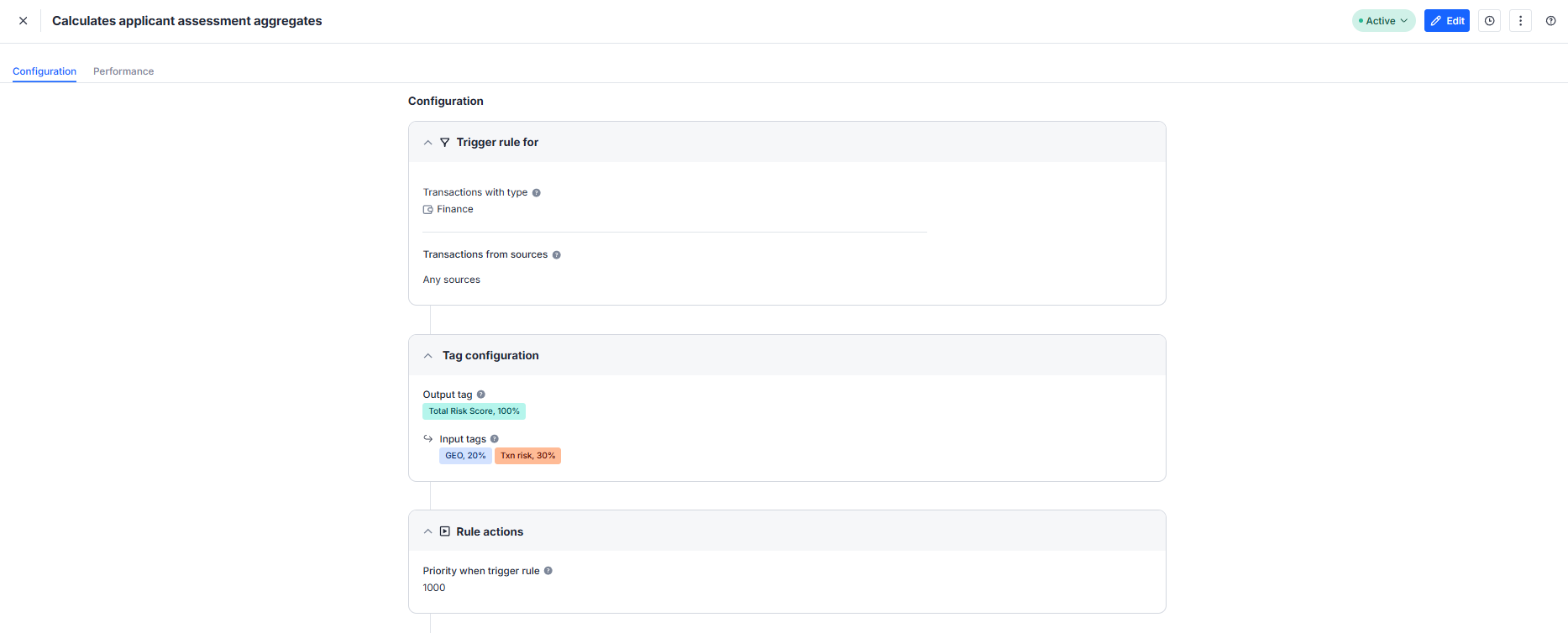

- Install the post-scoring rule Calculates applicant assessment aggregates from the Rules Library.

- Switch to Edit mode.

- Scroll down to Tag Configuration.

- Indicate the Output tag which will represent the total sum of all score factors (Total Risk Score in our case)

- Select the Input tags (risk factors) from the drop-down list (GEO and Txn risk in our case).

- Save your changes.

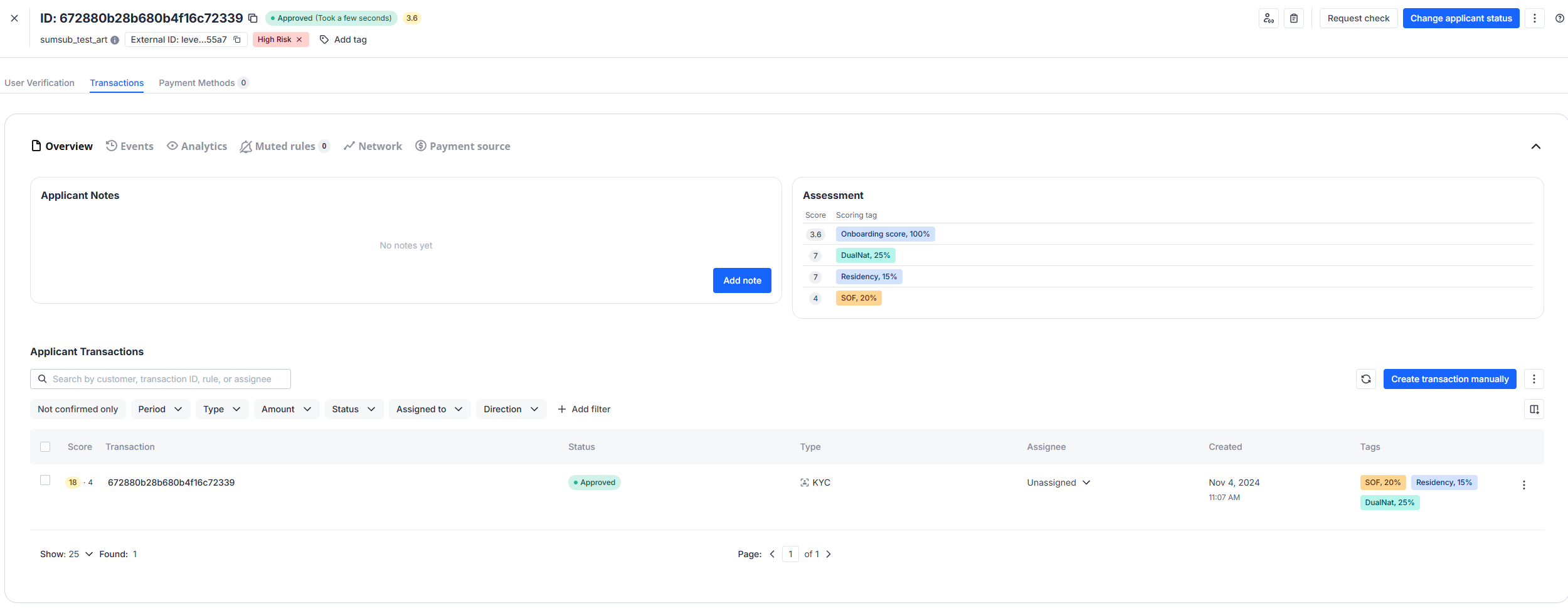

Review dynamic risk scoring results

To view the score, navigate to the Transactions section of the applicant profile and check the Assessment block.

Each time the rule containing the scoring tag is triggered, the total risk score in the applicant profile is updated as per the most recent transaction.

Updated 3 days ago