UK FinProm Regime

Use Sumsub to make crypto compliance a breeze.

Since October 2023, the FCA's Financial Promotions Regime (FinProm regime) has classified qualifying cryptoassets as high-risk investments.

Under the rules finalized in Policy Statement PS23/6, firms promoting these assets to UK consumers must comply with strict requirements for marketing communications and the strengthened consumer journey.

These measures aim to prevent consumer harm by giving retail investors time to reflect, better understand the risks, and ensure the investment aligns with their experience and risk appetite.

This page provides a brief overview of the UK FinProm regime and explains how Sumsub can help businesses comply with it.

Regime Overview

The strengthened UK Financial Promotions regime includes two main areas of obligation: compliant communication of promotions and a strengthened consumer journey.

Compliant communication of promotions

All promotions must be communicated or approved by an FCA-authorized firm or fall under limited exemptions.

As for the promotions themselves, they must be fair, clear, and not misleading, with prominent risk warnings and a balanced presentation of both benefits and risks.

To meet these rules, firms must conduct appropriate due diligence on the cryptoasset, the service, and any claims made in the promotion before communicating it.

For more details on these requirements and additional clarifications, refer to the Policy Statement PS23/6 and finalized guidance FG23/3.

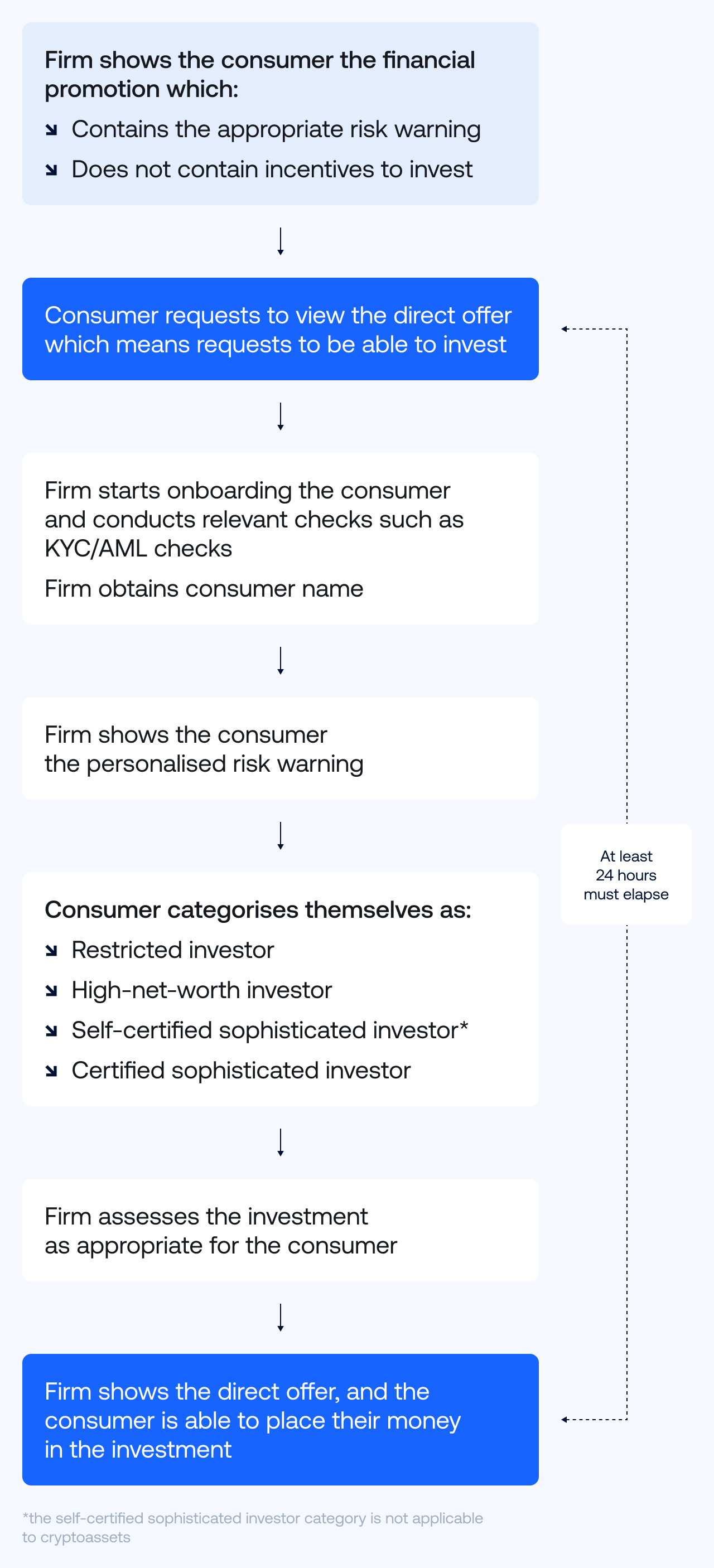

Strengthened consumer journey

The strengthened consumer journey includes the following mandatory measures, or “positive frictions”:

- All financial promotions must include clear risk warnings.

- Promotions cannot offer monetary or non-monetary incentives, such as “refer a friend” or welcome bonuses, that encourage investment.

- First-time investors must wait at least 24 hours (the cooling-off period) after showing interest before investing.

- First-time investors must see and acknowledge a personalized risk warning by clicking on a pop-up or in a similar manner.

- Individuals trying to invest must be categorized as retail, high-net-worth, or certified sophisticated investors before buying the assets.

- The firm must assess whether the investor has sufficient knowledge and experience for the investment.

- Firms should record various metrics throughout the consumer journey.

Sumsub does not provide solutions for the first area (compliant communication), but we offer automated tools specifically designed to help firms meet the requirements of the second area (the strengthened consumer journey).

The scheme below provides an example of how a firm can apply these measures.

Who is affected by FinProm regime

The FinProm regime is broad in application. It covers any financial promotion capable of having an effect in the UK, even if not specifically targeted at UK consumers.

As outlined by the FCA, it can be any promotion accessible via websites, apps, social media, or other channels that a UK consumer can view and respond to.

In other words, the regime applies regardless of the firm's location (UK or overseas) or the primary audience.

Additionally, the regime rules are technology-neutral and cover all formats, including social media platforms.

How to address UK FinProm with Sumsub

The Sumsub tools that let firms provide a strengthened consumer journey include:

- A fully customizable questionnaire designed to determine the customers' professional experience or knowledge of the target area.

- KYC, AML, and sanctions screening tools.

- A personalized risk warning pop-up.

- A customizable list of countries a client does not accept for verification by the Sumsub solution (for the companies that are not looking to work with UK residents).

How Sumsub helps strengthen consumer journey

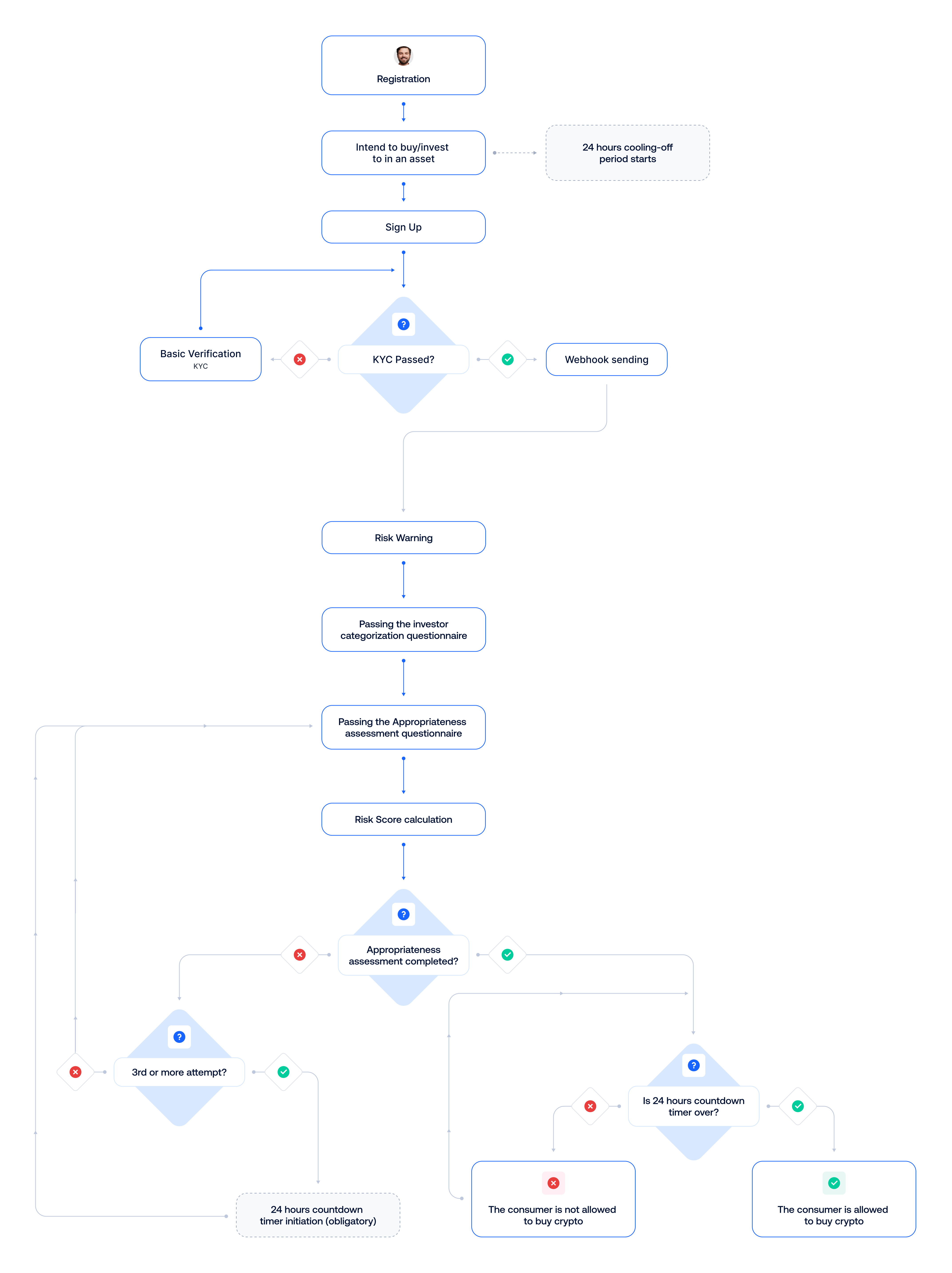

Below you will find the sequence of steps that need to be taken to perform the high-risk asset investment:

- The consumer (applicant) demonstrates intent to buy/invest in an asset, for example, by clicking a corresponding button.

- The 24-hour countdown timer is activated on your website to start the cooling-off period.

- The consumer can use the cooling-off period to prepare for the investment, for example, by signing up for your service. Registration triggers the KYC flow, set up in accordance with your AML/CFT obligations.

- After the applicant is approved or rejected, Sumsub sends a webhook to you.

- If the applicant is approved, the system displays a personalized risk warning. With Sumsub, this can be done either via a risk-warning questionnaire embedded in the main KYC level or as a separate applicant action after approval.

- The applicant is requested to categorize themselves into one of the FCA-defined investor types:

- Restricted investor

- High-net-worth investor

- Certified sophisticated investor

- Self-certified sophisticated investor (not applicable to crypto assets)

This categorization can be implemented as a questionnaire inside Sumsub.

- After categorization, the applicant must complete an Appropriateness Assessment questionnaire. It evaluates whether they understand the nature and risks of the specific crypto asset or product.

- Sumsub calculates its risk score based on the number of mistakes in the questionnaire. Any score other than 0 indicates the applicant made at least one mistake. You can use this score to build a custom appropriateness assessment logic and set a specific passing grade based on your business requirements.

- The applicant has two attempts to complete the questionnaire (one retake). If the applicant succeeds, they may invest in crypto assets. If the applicant fails for the second time, you must apply the 24-hour (or longer) cooling-off period before the third and each subsequent attempt.

NoteA separate Appropriateness Assessment questionnaire shall be created for each category of crypto assets (for example, exchange tokens or stablecoins) and/or products that pose additional/different risks for the end user.

The scheme below illustrates the process.

Prerequisites

The list below shows the features Sumsub provides and the steps you need to take on your end to set up the customer journey.

Sumsub provides:

- KYC and AML verification

- Customizable questionnaires

- Personalized risk warning step

- Investor categorization questionnaire

- Randomized Appropriateness Assessment questions

- Webhooks with checks‘ results

Client must handle:

- Cooling-off timers

- Creation of a separate questionnaire for each product

- Internal decision logic based on the Appropriateness Assessment results

- Final gating of trading or investing actions

If you have any questions about setting up your flow, contact us at [email protected] or reach out to your Customer Success Manager for seamless solution integration.

Updated 2 days ago